Verifiied® Digital Trust Registry

What Are Verifiable Credentials?

The world is full of credentials. A credential is a digital assertion containing a set of claims (identity attributes such as name, address, age, gender, etc.) made by an entity about itself or another entity. Passports, drivers’ licenses, insurance cards, and credit cards are all common examples of credentials. But while digital records are nothing new, today’s credentials come with certain “cryptographic superpowers” that make them tamper proof, secure, and verifiable.

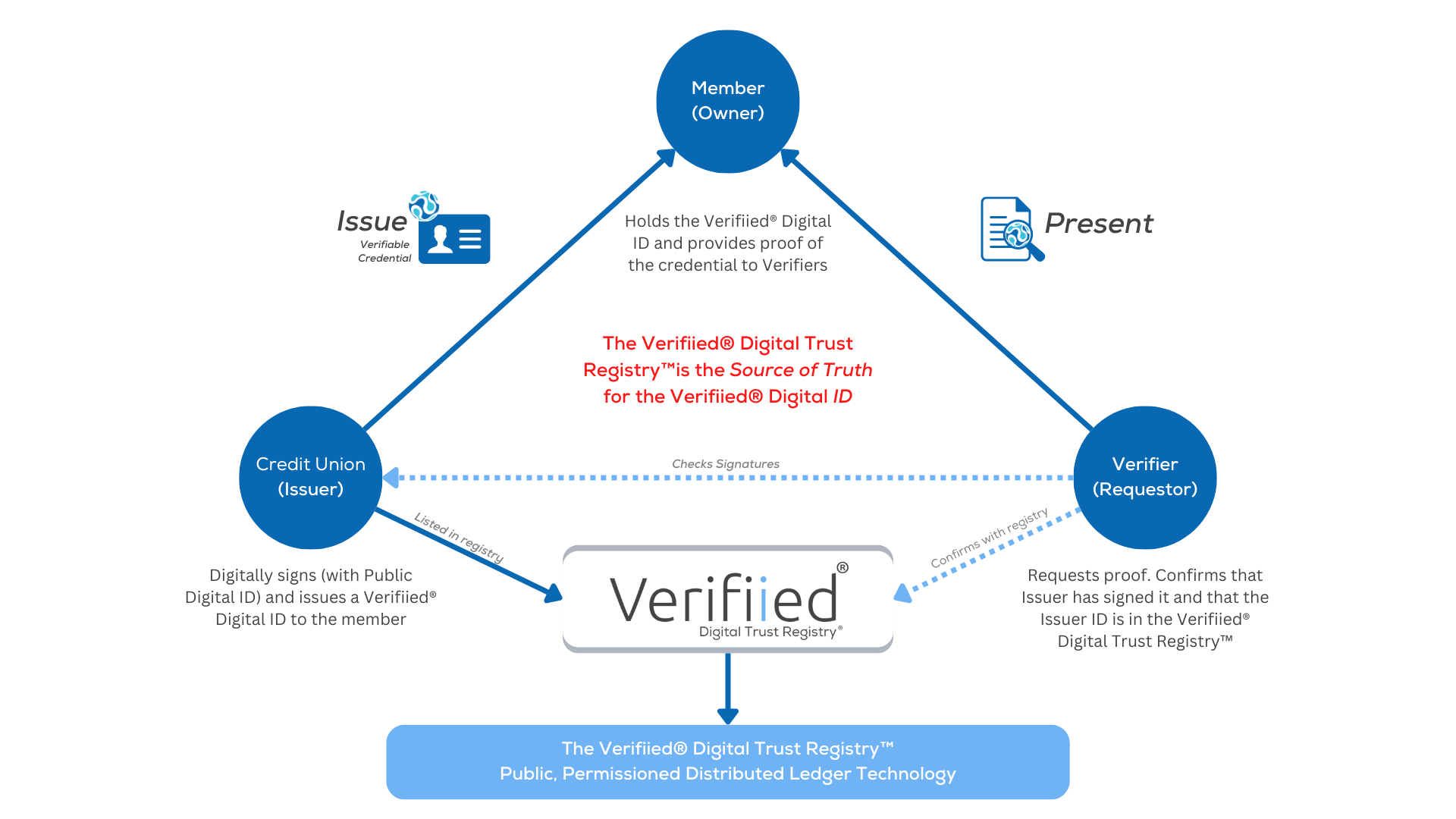

Credential verification is at the heart of the Verifiied® Digital Trust Network™, which is where two entities who have Verifiied® will exchange credentials, information or value on a private, secure peer-to-peer basis. Verifiied® was built upon internationally accepted digital credential standards, developed and published by the Worldwide Web Consortium (W3C); these standards have been accepted by many industries (not only financial services) for use in developing a verifiable digital credential schema. When digital credentials conform to the W3C’s (www.w3.org) verifiable Credentials Data Model, they are called verifiable credentials. They facilitate interactions using a pattern referred to as the Verifiied® Trust Triangle.

What Are Verifiable Credentials?

The world is full of credentials. A credential is a digital assertion containing a set of claims (identity attributes such as name, address, age, gender, etc.) made by an entity about itself or another entity. Passports, drivers’ licenses, insurance cards, and credit cards are all common examples of credentials. But while digital records are nothing new, today’s credentials come with certain “cryptographic superpowers” that make them tamper proof, secure, and verifiable.

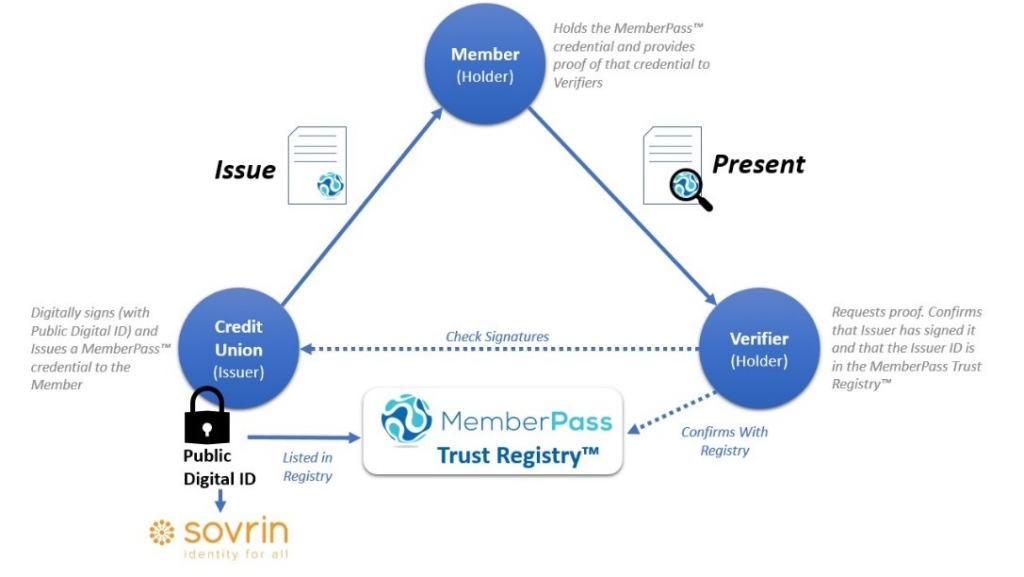

Credential verification is at the heart of the MemberPass Trust Network™, which is where two entities who have MemberPass™ will exchange credentials, information or value on a private, secure peer-to-peer basis. MemberPass™ was built upon internationally accepted digital credential standards, developed and published by the Worldwide Web Consortium (W3C); these standards have been accepted by many industries (not only financial services) for use in developing a verifiable digital credential schema. When digital credentials conform to the W3C’s (www.w3.org) verifiable Credentials Data Model, they are called verifiable credentials. They facilitate interactions using a pattern referred to as the MemberPass™ Trust Triangle.

What Are Verifiable Credentials?

The world is full of credentials. A credential is a digital assertion containing a set of claims (identity attributes such as name, address, age, gender, etc.) made by an entity about itself or another entity. Passports, drivers’ licenses, insurance cards, and credit cards are all common examples of credentials. But while digital records are nothing new, today’s credentials come with certain “cryptographic superpowers” that make them tamper proof, secure, and verifiable.

Credential verification is at the heart of the MemberPass Trust Network™, which is where two entities who have MemberPass™ will exchange credentials, information or value on a private, secure peer-to-peer basis. MemberPass™ was built upon internationally accepted digital credential standards, developed and published by the Worldwide Web Consortium (W3C); these standards have been accepted by many industries (not only financial services) for use in developing a verifiable digital credential schema. When digital credentials conform to the W3C’s (www.w3.org) verifiable Credentials Data Model, they are called verifiable credentials. They facilitate interactions using a pattern referred to as the MemberPass™ Trust Triangle.

The individual or small business member (Holder) requests verifiable credentials from issuers, holds them in a digital identity wallet and presents proofs of claims from one or more credentials when requested by verifiers (and approved by the holder).

The credit union (Issuer) is the source of the member credentials and issues a MemberPass™ to the member (holder). This is the digital membership pass which third parties can use to verify their members.

Any person, organization, or thing (Verifier) requests proofs from holders/provers of one or more claims from one or more verifiable credentials. If the holder agrees, (and the holder always has that choice), the holder’s digital wallet will respond with a proof the verifier can then verify.

When your credit union or any other organization needs the assurance that the MemberPass credential you are presenting is authentic, validation is provided via the MemberPass Trust Registry™.

The individual or small business member (Holder) requests verifiable credentials from issuers, holds them in a digital identity wallet and presents proofs of claims from one or more credentials when requested by verifiers (and approved by the holder).

The credit union (Issuer) is the source of the member credentials and issues a MemberPass™ to the member (holder). This is the digital membership pass which third parties can use to verify their members.

Any person, organization, or thing (Verifier) requests proofs from holders/provers of one or more claims from one or more verifiable credentials. If the holder agrees, (and the holder always has that choice), the holder’s digital wallet will respond with a proof the verifier can then verify.

When your credit union or any other organization needs the assurance that the MemberPass credential you are presenting is authentic, validation is provided via the MemberPass Trust Registry™.

The individual or small business member (Holder) requests verifiable credentials from issuers, holds them in a digital identity wallet and presents proofs of claims from one or more credentials when requested by verifiers (and approved by the holder).

The credit union (Issuer) is the source of the member credentials and issues a Verifiied® credential to the member (holder). This is the digital membership pass which third parties can use to verify their members.

Any person, organization, or thing (Verifier) requests proofs from holders/provers of one or more claims from one or more verifiable credentials. If the holder agrees, (and the holder always has that choice), the holder’s digital wallet will respond with a proof the verifier can then verify.

When your credit union or any other organization needs the assurance that the Verifiied® credential you are presenting is authentic, validation is provided via the Verifiied® Digital Trust Registry™.

How Does The Verifiied® Digital Trust Registry™ Work?

How Does The MemberPass Trust Registry™ Work?

How Does The MemberPass Trust Registry™ Work?

When you join the Verifiied® Digital Trust Registry™, your credit union’s Public Decentralized Identifier (DID) is written to a distributed ledger and listed in the registry.

This means that:

- When you are ready to issue Verifiied® credentials to your members, you can start right away.

- Other network participants will know you are registered as an Issuing credit union in the Verifiied® Trust Network™. No spoofing can ever take place since your credit union will be an authenticated participant in the network.

When other institutions receive one of your member’s Verifiied® credentials, they want to know two key things:

- That your credit union signed it cryptographically with your Public DID. This lets them know that the member data hasn’t changed.

- That your Public DID is listed in the Verifiied® Digital Trust Registry™. This lets them know that the credential came from a bona fide credit union.

When you join the MemberPass Trust Registry™, your credit union’s Public Decentralized Identifier (DID) is written to the Sovrin Global Identity Network and listed in the registry.

This means that:

- When you are ready to issue MemberPass™ credentials to your members, you can start right away.

- Other network participants will know you are registered as an Issuing credit union in the MemberPass Trust Network™. No spoofing can ever take place since your credit union will be an authenticated participant in the network.

When other institutions receive one of your member’s MemberPass credentials, they want to know two key things:

- That your credit union signed it cryptographically with your Public DID. This lets them know that the member data hasn’t changed.

- That your Public DID is listed in the MemberPass Trust Registry™. This lets them know that the credential came from a bona fide credit union.

When you join the MemberPass Trust Registry™, your credit union’s Public Decentralized Identifier (DID) is written to the Sovrin Global Identity Network and listed in the registry.

This means that:

- When you are ready to issue MemberPass™ credentials to your members, you can start right away.

- Other network participants will know you are registered as an Issuing credit union in the MemberPass Trust Network™. No spoofing can ever take place since your credit union will be an authenticated participant in the network.

When other institutions receive one of your member’s MemberPass credentials, they want to know two key things:

- That your credit union signed it cryptographically with your Public DID. This lets them know that the member data hasn’t changed.

- That your Public DID is listed in the MemberPass Trust Registry™. This lets them know that the credential came from a bona fide credit union.

Members

As the Verifiied® Trust Network™ grows, members will look for the credit union leaders that are building out services that they can use in their digital lives.

Developers

Developers using the Verifiied® API (aka CULedger.Identity) are already using the Verifiied® Digital Trust Registry™. As the Verifiied® Trust Network™ grows, the registry will be made public to developers that are integrating Verifiied® into their systems.

Credit Unions

Leading credit unions are building out the Verifiied® Trust Network™. Initially they are using Verifiied® in their own credit unions with members and employees. They also know that the value of Verifiied® grows as more organizations become issuers and verifiers in the network.

How can my credit union get started?

- STEP 1 – Join the Verifiied® Digital Trust Registry™ and establish your place on a distributed ledger or blockchain designed exclusively to support digital trust networks and verifiable digital credentials.

- STEP 2 – Begin issuing Verifiied®.

Members

As the MemberPass Trust Network™ grows, members will look for the credit union leaders that are building out services that they can use in their digital lives.

Credit Unions

Leading credit unions are building out the MemberPass Trust Network™. Initially they are using MemberPass™ in their own credit unions with members and employees. They also know that the value of MemberPass™ grows as more organizations become issuers and verifiers in the network.

How can my credit union get started?

- STEP 1 – Join the MemberPass Trust RegistryTM and establish your place on the Sovrin Global Identity Network, which is a distributed ledger or blockchain designed exclusively to support digital trust networks and verifiable digital credentials.

- STEP 2 – Begin issuing MemberPassTM.

Developers

Developers using the MemberPass API (aka CULedger.Identity) are already using the MemberPass Trust Registry™. As the MemberPass Trust Network™ grows, the registry will be made public to developers that are integrating MemberPass™ into their systems.

Members

As the MemberPass Trust Network™ grows, members will look for the credit union leaders that are building out services that they can use in their digital lives.

Credit Unions

Leading credit unions are building out the MemberPass Trust Network™. Initially they are using MemberPass™ in their own credit unions with members and employees. They also know that the value of MemberPass™ grows as more organizations become issuers and verifiers in the network.

How can my credit union get started?

- STEP 1 – Join the MemberPass Trust RegistryTM and establish your place on the Sovrin Global Identity Network, which is a distributed ledger or blockchain designed exclusively to support digital trust networks and verifiable digital credentials.

- STEP 2 – Begin issuing MemberPassTM.

Developers

Developers using the MemberPass API (aka CULedger.Identity) are already using the MemberPass Trust Registry™. As the MemberPass Trust Network™ grows, the registry will be made public to developers that are integrating MemberPass™ into their systems.

Get More Information, Schedule a Demo, or Stay in Touch